Robert Moore of Media Coding Industry Forum predicts adoption of VVC, HEVC’s successor, depends as much on geopolitics, semiconductor strategy and markets as on technical merit.

As global video traffic accelerates and quality expectations rise, content providers and distributors have reached a familiar crossroads – determining which codec will carry the industry forward.

The question of what defines a successful codec has become critical at a time when the world’s video workflows still rely on yesterday’s technology and when network operators, device manufacturers and content platforms are trying to manage – and profit from – rising video consumption. For Versatile Video Coding (VVC), the successor to HEVC and one of the most efficient compression standards available, adoption will be influenced not only by technical merit but also by geopolitical considerations, semiconductor strategies and the timing of market demand.

In a recent vidcast interview for journalists, Robert Moore, President of OP Solutions and a member of the Media Coding Industry Forum (MC-IF), discussed why widespread adoption of VVC is inevitable, sooner or later.

Video Compression and Streaming Media

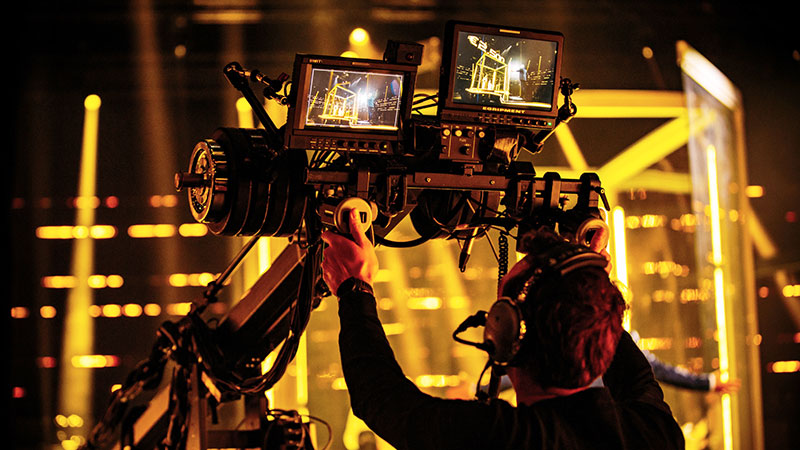

When he founded OP Solutions (OPS) in 2017, Robert was aware that streaming media had become a key feature of nearly all devices with screens or cameras and, in turn, that efficient video compression is critical to streaming media. He also recognised that, as the resolution and quality of streamed media improves and new streaming applications emerge, the demand for better video compression will continue to grow.

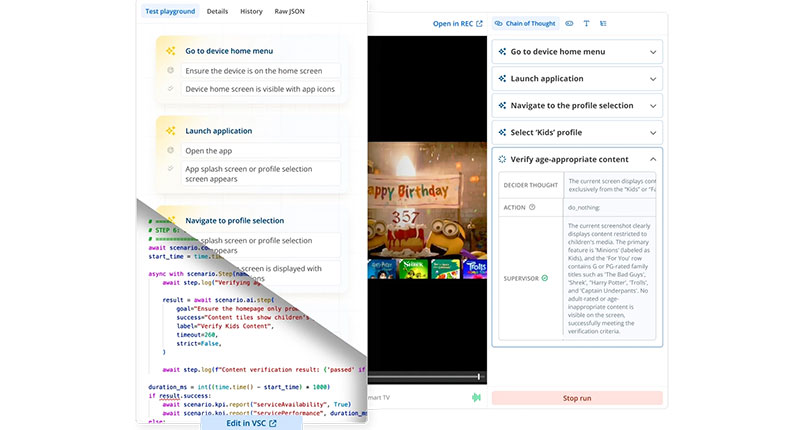

In order to ensure that upcoming video compression standards would benefit from university expertise, OPS began its collaboration with Florida Atlantic University the following year, sponsoring the research of FAU professors, students and video compression experts, and their participation in setting standards. So far, their work includes standards for Versatile Video Coding (VVC, also known as H.266, ISO/IEC 23090-3, and MPEG-I Part 3), finalised in 2020, and the upcoming standards Video Coding for Machines (VCM) and Green Supplemental Enhancement Information (Green SEI).

OP Solutions is a founding member of the Media Coding Industry Forum, which helps the participants in VVC standardisation and those likely to implement the codec agree on licensing of associated patents. It has been noted that the slow adoption of VVC's predecessor HEVC has partly been caused by its licensing complexity, which involves numerous licensing entities. H.266 VVC is a royalty-bearing codec and its licensing model needs to be made clear. (See below.)

Hardware Developers vs Content Providers

“There is often some back and forth as to whether content providers or hardware suppliers will be the first to adopt a codec,” Robert said. “Traditionally, chip suppliers make the first move, creating an installed base in hardware. Over time, content providers follow once that installed base reaches critical mass.” That is, when the installed base is large enough to make adopting a new codec worthwhile, content will follow.

The history of HEVC illustrates this trajectory. After the codec was finalized in 2013, major system-on-a-chip (SoC) vendors MediaTek and Qualcomm (member of MC-IF, which has endorsed VVC) quickly integrated it into their mobile platforms. Apple adopted it soon after. Combined, these three companies represented 75 to 85 percent of the global phone market, and sharply accelerated HEVC’s penetration.

Robert expects VVC to take a similar path. MediaTek has already announced support, integrating VVC into its main TV platforms, and Intel is enabling VVC playback on upcoming laptop products. “The expectation is that other manufacturers will follow,” he said.

Mobile – the Next Milestone

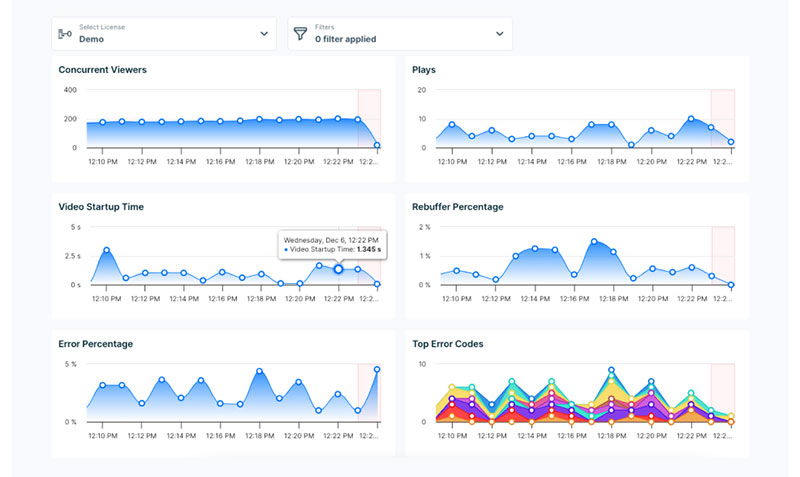

Now that adoption is underway in TVs and PCs, mobile phones represent the next hurdle for VVC, and possibly the most consequential. According to Ericsson’s Mobile Network Data Traffic Update for Q2 2025, mobile network traffic grew 19% year-over-year, driven largely by an increase in smartphone subscriptions and rising online video consumption.

“Last year, Qualcomm and MediaTek held between 50 and 60 percent of worldwide mobile SoC share,” Robert noted. “Apple accounted for about 20 to 25 percent, and HiSilicon held another 10 to 15 percent.” He believes these four companies will ultimately determine which codecs dominate mobile devices, and once one supplier integrates VVC, he expects rapid follow-on adoption. “The question is simply which one will go first,” he said.

A Global Codec

While discussions about new codecs often focus initially on technical considerations, the influence of the geopolitical environment is gaining strength. “For instance, there has been widespread Chinese participation in VVC standard setting,” Robert said. “In 2020, I co-authored an article showing that three of the top five companies with accepted contributions to VVC were based in mainland China.”

China’s active role reflects a strategic interest in cultivating alternatives to Western-centric technology platforms. But VVC is not a regional standard – it is genuinely global. Companies from China, the United States, Korea, Japan and Europe, among others, have been deeply involved in its development.

Robert emphasised, “This is a global standard, and for some Chinese companies, VVC may present less geopolitical risk than adopting proprietary alternatives from the West, such as AV1 or even AV2.”

Licensing, Patents and Pricing

Regarding licensing, a major concern in any codec transition, Robert argues the issue is often overstated. “Between 2003 and 2009, MPEG LA launched its H.264 pool at 20 cents per unit – about 35 cents today when adjusted for inflation,” he said. “There was broad participation, and the industry accepted the price.”

Today, the two primary patent pools – agreements between patent owners to license their patents to each another or to third parties – overseeing licensing for VVC are Access Advance and Via LA. The latter was formed through the merger of MPEG LA and Via Licensing Corporation. Both organisations also administer licensing programs for HEVC, and each has deliberately structured its VVC policy to minimise the incremental cost for companies already participating in their HEVC pools.

Under Access Advance’s model, an HEVC license in the US costs approximately 40 or 20 cents per mobile device depending on the country of sale for the mobile device. For devices that include both HEVC and VVC, the royalty is 50 or 25 cents per mobile device. Via LA, on the other hand, sets its HEVC license at roughly 20 cents per unit and adds VVC at no extra cost to existing HEVC licensees.

“Together, these pricing structures position VVC’s licensing fees significantly below historical norms when adjusted for inflation, reducing one of the perceived barriers to codec adoption in the future,” said Robert. Considering that the mainstream smartphones now typically cost over $800, the incremental cost becomes negligible. “Pointing to patent royalties as a barrier ignores both history and the overall benefit of the codec,” he said.

The Efficiency Factor

Beyond geopolitics and licensing structures, the strongest argument for adoption of VVC lies in its ability to enhance efficiency across the video ecosystem. Now that video accounts for roughly 80% of global internet traffic, the industry is under pressure to find ways to reduce bandwidth consumption without compromising quality. “Compressing video more efficiently brings significant advantages as video traffic continues to rise,” Robert noted. “More efficient codecs serve as a way to reduce strain on networks and lower storage requirements in the cloud.”

Also consider that, over time, users expect their devices to continue supporting more sophisticated formats – from 4K and 8K streaming to HDR, high-motion sports content and emerging immersive experiences. VVC directly addresses these demands. Its compression tools handle higher-quality video at substantially lower bitrates, easing the pressure on congested mobile and fixed networks.

Lower bitrates mean less energy is required for video playback as well, prolonging battery life on mobile devices. The improved efficiency also lowers costs for users in terms of cloud storage and distribution, where video files make up the overwhelming majority of data volume. www.mc-if.org